Can state deficit spending be used to artificially add to the mass of profits? And if so, would deficit spending account for the rather ambiguous (even contradictory) results labor theorists’ produce when they try to empirically substantiate Marx’s thesis on the falling rate of profit?

In his 2013 paper, the Australian labor theorist, Peter Jones, provided a persuasive argument that the fascist state can indeed augment or subsidize the rate of profit through its deficit spending. And he argues this capacity can explain much of the ambiguous results labor theorists have produced over the last three decades as they attempt to empirically demonstrate or disprove Marx’s argument on the role played by the falling rate of profit in capitalist crisis.

According to Jones, government borrowing mystifies economic relations by making it appear as if the state can consume surplus value without reducing either profits or wages. If labor theorists do not account for this false appearance, they are implicitly accepting the Keynesian assumption embedded in mainstream economics that government borrowing can create new surplus value.

In his 2012 paper, “Could Keynes end the slump? Introducing the Marxist multiplier”, Gugliemo Carchedi discussed how Keynesian deficits spending works and, like Jones, concluded this deficit spending cannot create money (or, more accurately, value) out of nothing. However, he went one step further: Carchedi argued that once the state began to repay its debt, it would have to raise taxes for this purpose. Whatever additional ‘demand’ the state created by deficit spending during an economic downturn would turn out only to be deferred taxation on the population. Essentially, since the state is not a producer of commodities, it could only bring spending forward; this credit funded ‘prosperity’ would have to be repaid at some point by higher taxes.

Carchedi’s argument may or may not be correct in the long run, but Jones’ paper suggests Washington has been able to run deficits — and, therefore, artificially prop up profits — over a fairly long period of time without running into the need to balance its budget. For more than thirty years, the US has been able to spend more than it takes in without apparent difficulty or obvious limits.

Although Jones seems to believe Marx’s theory does not account for the additional profit, in my last post I argued the source of these additional profits is likely to be explained by the material impact of the law of the tendency of the rate of profit to fall itself on the economy. According to Marx, the law does not simply produce ‘crisis” in the abstract, it produces a mass of forcibly idled capital and workers:

“A drop in the rate of profit is attended by a rise in the minimum capital required by an individual capitalist for the productive employment of labour; required both for its exploitation generally, and for making the consumed labour-time suffice as the labour-time necessary for the production of the commodities, so that it does not exceed the average social labour-time required for the production of the commodities. Concentration increases simultaneously, because beyond certain limits a large capital with a small rate of profit accumulates faster than a small capital with a large rate of profit. At a certain high point this increasing concentration in its turn causes a new fall in the rate of profit. The mass of small dispersed capitals is thereby driven along the adventurous road of speculation, credit frauds, stock swindles, and crises. The so-called plethora of capital always applies essentially to a plethora of the capital for which the fall in the rate of profit is not compensated through the mass of profit — this is always true of newly developing fresh offshoots of capital — or to a plethora which places capitals incapable of action on their own at the disposal of the managers of large enterprises in the form of credit. This plethora of capital arises from the same causes as those which call forth relative over-population, and is, therefore, a phenomenon supplementing the latter, although they stand at opposite poles — unemployed capital at one pole, and unemployed worker population at the other.”

Which is to say, Carchedi may not only be wrong, he is ignoring the most important consequences of a falling rate of profit: the fall in the rate of profit leaves billions of hours of value in the form of otherwise unemployable capital and labor at the disposal of the fascist state to employ as it sees fit. This is a mass of capital and labor power that has been rendered superfluous to the production of value and surplus value by the progressive improvement in the productivity of labor.

Kliman’s concession to opponents of the falling rate of profit thesis

There is a lot of controversy over whether the 2008 financial crisis was caused by a fall in the rate of profit. Much of this debate — between, for instance, Dumenil and Levy, on the one hand and Andrew Kliman, on the other — concerns whether there are underlying objective laws determining the development of the mode of production. One group argues the crisis was unrelated to a falling rate of profit; the other views a fall in the rate of profits (secondary to a rising organic composition of capital) as the cause.

The question raised by Jones’ paper is whether these two views are as incompatible as the participants appear to believe. Although it is not widely noted, in a 2009 publication of his findings, Andrew Kliman admitted the rate of profit actually rose in the years immediately prior to the crisis. The gist of Kliman’s actual argument in that presentation was that the falling rate of profit was not the direct cause of the financial crisis:

“The data presented above show that (historical-cost) rates of profit either failed to recover between the troughs of 1982 and 2001 or continued to decline. Yet they also show that there was a sharp rise in profitability in the middle of the current decade, until the economic crisis erupted. Even the revised BEA data presented in Table 3 indicate that profitability rose sharply (though by a bit less than the unrevised data). Given this last fact, and given that rates of profit with before-tax profits in the numerator flattened out rather than continuing to fall in the 1980s and 1990s, it may be thought that the fall in the rate of profit cannot help to account for the current crisis; the lag is just too long. However, I do not think this is the case.

It is certainly true that a fall in the rate of profit was not the proximate cause of the crisis. If we seek to move beyond journalistic accounts that merely correlate current events, however, we must look for longer-term developments that set the stage for crisis and thus served as indirect causes. This paper argues that the fall in the rate of profit was a key indirect cause.”

According to Kliman then, the falling rate of profit was not the proximate cause of the crisis, but the indirect cause of the crisis. Kliman’s argument likely means he had no real explanation for why the rate of profit should be rising in the years immediately prior to the crisis — he was grasping at straws to explain the results of his own empirical results: inexplicably, the profit rate stopped falling in 2001 and rose from that point until the onset of the financial crisis.

According to Kliman, a fall in the rate of profit does not immediately lead to a crisis, but produces a speculative blowoff top:

“The fall leads first to increased speculation and the build-up of debt that cannot be repaid, and these are the immediate causes of crises. Thus, the timing of the current crisis and the sequence of events leading to it do not contradict the theory, but are fully consonant with it and lend support to it. Nothing anomalous has occurred that requires us to look elsewhere for explanations.”

The speculative bubble, Kliman alleges, is a natural result of the falling rate of profit. According to Kliman then the falling rate of profit drives the speculative bubble and culminates in the crisis.

“Because the fall in the rates of profit and accumulation lead to crises only indirectly, they do not do so immediately. They lead first to shorter or longer periods of heighted speculation. It is only when debts finally cannot be repaid that a crisis erupts, which then leads to stagnation”

But there is a problem with this explanation: as any brief examination of major stock market indices during the period will confirm, the rise in the rate of profit marked in Kliman’s data comes on the heels of a massive crash in the stock market. Kliman is selling his readers a smelly truckload of bullshit on this. According to his own data, the rise in the rate of profit preceding the financial crisis began in 2001 – not the mid-decade as he asserts; and this rise begins with a speculative crash of the dotcom bubble in 2000-2001!

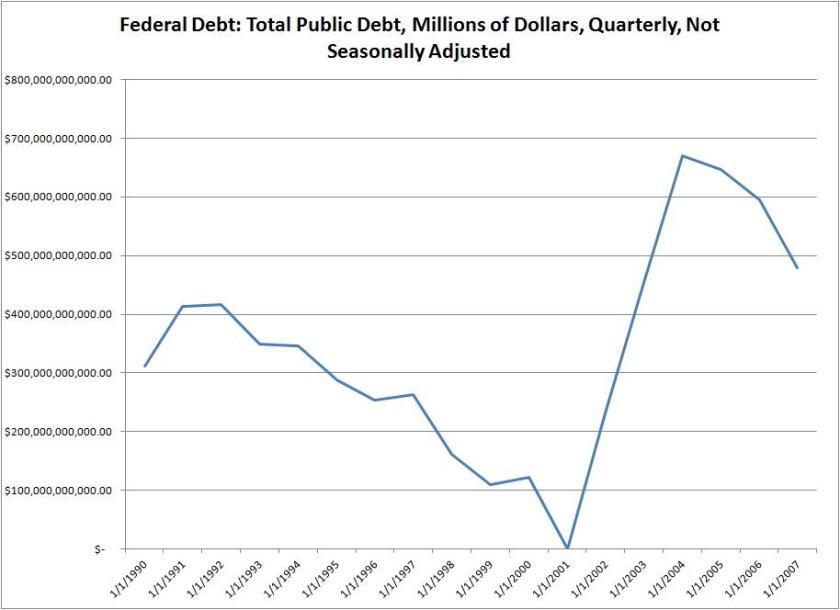

The rate of profit begins to rise not on a speculative bubble, but in the immediate aftermath of the bursting dotcom speculative bubble. Compare Kliman’s argument to the chart above and this one:

In Kliman’s own data, the profit rate begins to rise only in the aftermath of the dotcom bubble crash — which is exactly the opposite of what we would expect if we accept Kliman’s explanation. This suggests something is at work in addition to the speculative frenzy Kliman introduces from Marx’s argument.

Essentially, the argument Jones is making in his 2013 paper, (although he does not seem to recognize it), is that the real rate of profit was falling in commodity money terms; even as the fascist state was trying desperately to forestall this fall in nominal (dollar denominated) terms. This situation is only possible if the dollars are no longer pegged to a commodity money. Jones calls the profits being measured by Kliman and others “fictitious profits” — profits are generated not by the production of value, but by increasingly large fascist state deficits. To give an example of the point Jones is making, here is the federal deficit for 1990 to 2007 — compare it to Kliman’s data on the rate of profit above:

It would take someone better at this than I am to confirm it, but it appears there is at least a rough correlation between the profit rate and federal deficits. During the Clinton administration Washington’s deficits fell for most of the 1990s, the rate of profit began to follow it down at about mid-point in the 1990s. The profit rate only began to rise after the Federal deficit began to rise with the so-called Bush ‘tax cuts for the rich’. And both the deficits and the profit rate rise right into the financial crisis.

One possibility is that Marx is wrong and the rate of profit does not produce crises as the rate of profit chart suggests. The second possibility is that the rate of profit had, as Kliman suggests, never really recovered at all and was being more or less propped up by federal deficits beginning with the Reagan administration.

This is where the proponents of the rate of profit thesis completely fuck up their analysis, I think.

In Marx’s argument, the falling rate of profit does lead to a crisis — but what sort of crisis does it lead to? According to Marx, the crisis itself is expressed as a mass of capital incapable of action on its own and a surplus population of workers — which is to say. money-capital cannot find profitable outlets, factories stand idle and large numbers of workers are unemployed. In other words, if left unchecked by fascist state intervention, the falling rate of profit produces what amounts to a depression.

Paradoxically, however, the crisis also places at the disposal of the state a very large mass of superfluous capital that the state can employ as it sees fit. By borrowing the superfluous capital, two things are accomplished simultaneously: the excess capital is consumed unproductively and the state pays interest on the consumed capital to the capitalist class — adding to the mass of profits. It is, therefore, entirely possible for the rate of profit to be falling in commodity money terms, yet be rising in dollar denominated terms. The defenders of the falling rate of profit ignore the impact the collapse of the gold standard in 1971 had in fascist state economic policy

The state was no longer constrained by the gold it had in its vaults to redeem the dollars it issued. It could, at least in theory, force dollars into circulation or issue bonds payable in dollars as IOUs. Since bonds are only payable in inconvertible fiat dollars which are the most universally recognized means of exchange throughout the world market, and since Washington has unconstrained control over issuance of this valueless currency, in theory at least Washington cannot default on its obligations — which, again, in theory at least, makes Washington’s debt the most riskless debt within the world market.

I will look at the implications of this next.

tangentially related:

http://imgur.com/f2V8sub

lol. that is all

LikeLike

“People accept this because it’s free…” LOL

LikeLike

Why do you insist on using ‘fascist state’ to refer to what’s clearly a liberal state? It’s really silly.

LikeLike

Because liberal democracies can be fascist. Why do you mistakenly think this is not possible? Did you know, for instance, the FDR began the new deal by devaluing wages by 40%? Would you call that a liberal policy or a fascist one? Or, most confusing of all, a fascist policy by a liberal democratically elected politician?

LikeLike