NOTE FOR THE READER: I want to reiterate that fascism, in the sense I use the term, only describes a state managed economy. I need to clarify again that my argument is not that modern money theory (MMT) is wrong, but that it correctly describes how fascism works. Nor do I wish to suggest that fascism means MMT is Nazism — many people who could never be described as Nazis embrace MMT insights. A fascist state, as I use the term, must be contrasted with a commune of the social producers, not with ‘democracy’ or a bourgeois republic. In fascism the bourgeois state manages the economic activity of the whole society, while a commune of social producers is self-managed. If the reader fails to keep these critical ideas in mind when reading this post, nothing much of my argument will make sense to you.

*****

A ‘sufficient’, but not ‘necessary’ cause?

At this point, I want to discuss a critical weakness in Tymoigne and Wray’s “Modern Money Theory 101: A Reply to Critics”, that is exposed when a third, external trade, sector is introduced to the simple two-sector MMT model of an  economy. In the simple two-sector model, the means of exchange used by society in its exchange relations is assumed to be supplied by the state. According to MMT, the preference for state issued inconvertible fiat currency — over commodity money or bank notes — is that the state imposes taxes for which it only accepts its currency as payment. This, the writers argue, is sufficient to explain what “drives” state fiat as currency:

economy. In the simple two-sector model, the means of exchange used by society in its exchange relations is assumed to be supplied by the state. According to MMT, the preference for state issued inconvertible fiat currency — over commodity money or bank notes — is that the state imposes taxes for which it only accepts its currency as payment. This, the writers argue, is sufficient to explain what “drives” state fiat as currency:

“The simple fact is that almost all monies of account are ‘state monies’ and almost all government currencies do have taxes or other obligations standing behind them. Further, even if one can find a money of account and a currency that has no fee, fine, tax, tribute, or tithe backing it, that would not invalidate MMT. Perhaps Palley does not understand the difference between ‘necessary’ and ‘sufficient’ conditions: a tax (or other involuntary obligation) is sufficient to drive a currency; it might not be necessary. MMT theory relies on the sufficient condition, not the necessary condition.”

For the moment, I will overlook the questionable assertion that “almost all monies of account are ‘state monies'”. For July alone, in the US, consumer credit outstanding — a money form that is not in any way a ‘state money’ amounted to $3.2 trillion. This private money is, of course, denominated in US dollars, but it is a privately issued money form that seldom takes the form of state currency.

What drives the choice of currency in international trade?

But, I am going to ignore this gaping hole in the argument of the MMT school, because there is a much juicier target when MMT has to explain the forces that “drive” the choice of currency in the international sphere. When the external trade sector is added to the simple two-sector MMT model, the writers argument that taxes are a ‘sufficient’ condition to explain the monetary sovereignty of the state sector begins to fall apart.

It is obvious that the state can force by fiat its own currency to circulate as means of exchange within the territory under its control, however, the laws of no nation extend beyond its own borders except as an act of aggression against another nation. The US cannot force the citizens or state of Mexico to recognize its currency as official means of exchange for international trade, nor can Mexico for the US. The US cannot impose taxes on the citizens or state of Mexico, nor can Mexico imposed taxes on the US.

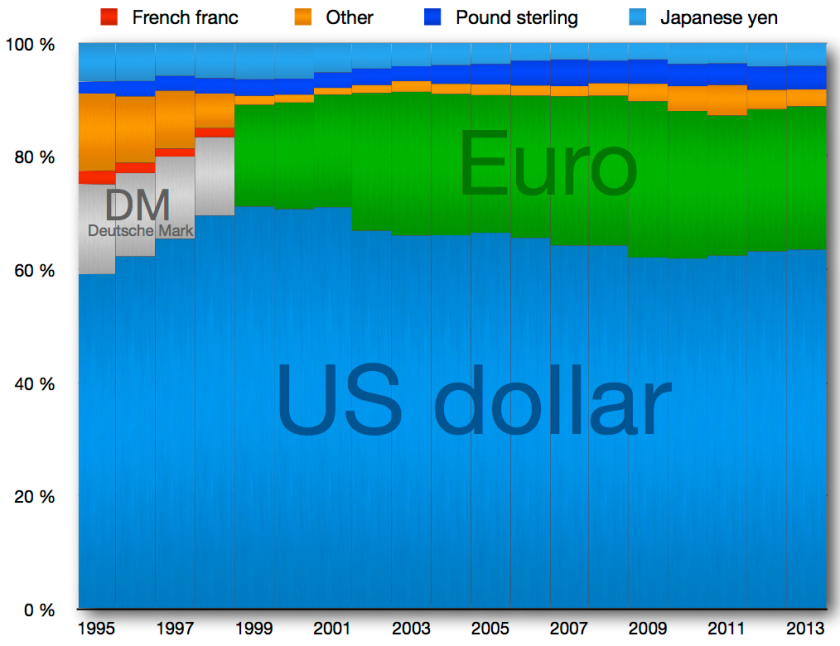

Despite this, Mexico and a host of other countries accumulate dollar reserves and very often denominate their exports in dollars. Moreover, dollars account for one side of the vast majority of all international transactions. Tymoigne and Wray offer that taxes imposed by the US state on US citizens and Mexico’s taxes on its citizens is sufficient to explain the domination of the state issued currency of one state in international trade. They admit the domination of the dollar as international reserve currency is not determined by Mexico and US taxes, but still insist the function of some state issued currency as the international reserve currency can be sufficiently explained by the fact that taxes are imposed on citizens in almost all nations.

According to Tymoigne and Wray, “MMT theory relies on the sufficient condition, not the necessary condition.” What they really mean to say is they have no explanation for why the dollar (or any other national currency) is the reserve currency, but national taxes seem like as plausible a reason for this as anything else. Since the world market is composed of nation states, it only seems logical that the currency of one should come to dominate world trade. What one has to do is explain why state currency dominates trade of a particular country, then you can explain why one currency dominates all the rest in world trade.

As I have already shown, while MMT can only rely on a “sufficient” cause, labor theory begins with a necessary cause, i.e., with overproduction of capital, the Great Depression and the hoarding of commodity money. The hoarding extended to the international sphere in 1971, when, under pressure from its trade partners, the US was forced to end the dollar’s peg to the gold standard. In labor theory, state issued currency comes to dominate international trade because there were no alternatives to state issued currency. Simply stated: If a state issued currency was not employed as world money, there would be no world money — gold was being hoarded in the international sphere just as it had previously been hoarded within each state.

Monetary sovereignty in the international sphere

Only once the necessary condition for some particular state issued currency to serve as international reserve currency has been established — an event premised on the final collapse of the gold standard and the Bretton Woods agreement — does it become necessary to examine the implications for the world market once a state issued currency begins to serve in this role.

Up to this point, employing a state issued currency as international reserve can be pawned off to an accident of history or a random choice; it could be said that people or countries choose one or another currency as international reserve out of convenience. However, once the necessity of state issued currency as international reserve has been established, the implications of this fact for the entire world market jumps to the fore. The fact points to a brutal contest among nation states over which currency shall serve as the international reserve currency precisely because, as in the case of the domestic sector, having the particular currency of some state established as world reserve gives that state the sovereign position in relation to the entire world market that each state had previously only in relation to its domestic market.

The nation state controlling the international reserve currency finds that the productive capacity of the entire world market is at its disposal. Everything that holds with regards to the state’s control over what serves as means of exchange in a particular economy, holds for the international reserve currency within the world market as a whole. In first place, this means that, by controlling the world reserve currency, “A government can always afford to buy anything for sale denominated in its currency”.

This explains the error Robert Kurz made in his prediction of 1997 that the dollar would be rejected as world reserve currency:

“The United States has succeeded in and continues to succeed at—although it should be economically impossible—going deeply into debt to foreign capital while simultaneously having very high trade deficits, for the simple reason that the dollar played and to some extent still plays (in a diluted form) the role of world money. This means that the U.S. can pay off its foreign debt with its own currency, instead of first having to obtain foreign currency by generating a trade surplus in order to pay the interest on and amortize its foreign debt. In reality, it makes its foreign creditors pay part of its debt by means of raising and lowering the dollar’s exchange rate, although this method appears to have now lost a great deal of its efficacy and will sooner or later lead to a generalized flight from the dollar, which would result in a drastic collapse of the currency’s value and a world trade crisis. The weakness of the dollar and the crisis of the international monetary system over the last two years clearly demonstrate that the trend points in this direction.”

In fact, contrary to Kurz’s prediction, when the crisis exploded in 2008, the role of the dollar as international reserve was strengthened by a headlong rush to get into US treasuries even at negative interest rates. The reaction of the world market to the crisis by flight into treasuries was not unlike the reaction before 1929, when crises drove money capital into gold and other commodity monies. The distinction, however, is telling: Unlike in the period before the Great Depression, when the owners of capitals acted to hoard gold; in 2008, these owners frantically competed with one another to lend their money capital to the fascist state in Washington.

The world market and competition among fascist states

Thus, once Tymoigne and Wray add in the private sector to their simple MMT model of an economy, a profound change occurs. While, previously, the state that issues debt only in its own currency can be a monetarily sovereign government, once the foreign sector is included, what was previously an absolute sovereignty of the state is transformed into a merely relative status hedged in by competition among nation states. While, to some extent, the state may remain sovereign within its domestic economy, to the extent this domestic production aims at exports beyond the borders of the state, the status of the state as monetary sovereign becomes merely relative. Unlike in the case of the domestic economy, the state cannot simply impose its currency as exclusive means of exchange on the world market by fiat — this position has to be conquered.

The domestic economy, dominated by its particular state, engages in material production relations with a number of other domestic economies — each of which are dominated or represented by their own particular states. Within the production relations of the world market, each of these national economies count only as an aliquot or proportional part of the total world market, not as autarchic national economies. It may appear superficially as if they remain distinct national organisms, each regulated by their particular fascist state, but this is an illusion mostly generated by the fact that each national state accounts for the production of its own national capital, much like each corporation account for the production of its own firm.

Although statistics produced by individual states presume each is an autarchic (self-sufficient) organism unto itself, reality is otherwise. Within the world market as a whole the domestic economies of each nation function effectively together as a single machine for the production of surplus value. Thus, there is not, as even some Marxists appear to believe and as MMT takes as a given, 200 competing national economies, but a single world market economy composed of 200 competing national capitals. This single world market economy is the source of all material and social wealth; while the nation states, among which this world economy is divided, have the same relation to the world economy as any state has to its domestic economy in the simple two-sector model.

Which is to say, none of these nation states produce anything, but live on the combined product of the labor of the entire world market.

The so-called third sector of the simple MMT model is an illusory artifact produced by the fact that MMT is a fascist ideology and views things from the standpoint of the fascist states. The three sector MMT model can, therefore, be simplified once again into a two-sector model with the ‘real assets’ within the world market taken as a whole and a state sector composed of competing nations states — each of which control some definite portion of the total ‘real assets’ (capital) of the world market.

Debt is not money

According to Tymoigne and Wray, one national capital can create ‘financial instruments’ that promises to deliver payment in the currency of another national capital. The statement is bizarre, because the writers seem to be implying a national capital can create debt. It is common among economists to suggest Washington ‘creates’ or ‘issues’ treasuries and sells these treasuries to ‘investors’; but treasuries are nothing but IOUs and, logically, one does not ‘create’ IOUs. One simply borrows capital and signs a promise to repay the loan. While the formulation employed by Tymoigne and Wray is common enough in the literature, it necessarily creates the false impression that debt is a form of money and it further leads to the silly idea the state can create money out of nothing simply by ‘issuing’ debt.

However, when a state borrows money capital, who is actually creating money?

According to Tymoigne and Wray, this question hangs on a legality, but legality has nothing to do with it. When money capital is borrowed, the lender always creates the money by lending it. This money is called ‘credit money’ and is thought, by many Marxists, to be the ‘natural’ money of the capitalist mode of production. Credit money is created by lending, it is destroyed when repaid; none of this has anything to do with the IOUs issued by the state; the IOUs are nothing more than a promise to repay the credit plus some definite interest.

When China advances its commodity capital to the United States, the creation of money is accomplished by the advance of the commodity capital, not the borrowing. Of course, as the writers argue, by this lending, China indeed does not create dollar currency, but it nevertheless creates credit money. It does not do to conflate the creation of money with the creation of currency as MMT does. While it is true that currencies are issued by their respective nation states, this does not imply states issue money. In the capitalist mode of production money is issued mainly in the form of credit money and this credit money may be denominated in any of dozens of currencies — euros, pounds, dollars, yen, etc.

However, this is the point: to issue credit money, you have to have a commodity to sell! Since, in our simplified model, states have no commodities to sell, they cannot issue credit money. And this is the second point, even though states have no commodities to sell they can still issue (i.e., counterfeit) their currencies. The fact that states do not issue money in the mode of production does not in the least prevent states from counterfeiting their currencies. To put this in the simplest terms possible: the creditor creates money by advancing his capital (capital in the form of commodities) to the borrower; while the state can create its currency out of nothing.

Thus, for example, China advances its commodity to the United States; while the United States creates currency out of nothing to repay it. Now, why would China do this? Doesn’t it seem patently absurd? China advances to the US good capital in return for an IOU that basically says the US can counterfeit its currency to repay the debt. The arrangement means the US can never default on its debts to China, since it has only agreed to counterfeit its currency if necessary. The risk borne by China is that the US will arbitrarily refuse to repay or will, in fact, counterfeit its currency into hyperinflation.

How China pre-funds the US budget deficit by advancing its commodities

Although I arrive at the same conclusion as MMT, the monetarily sovereign government can never involuntarily default, new questions open up. The biggest question is why would China agree to this sort of puzzling arrangement? Why would China advance its money capital to the US on a promise to be repaid in valueless inconvertible fiat dollars? The answer is simple: China has no alternative to this arrangement.

MMT is completely right to state foreigners do not supply US dollars to the US government, but this is completely beside the point. China advances its commodity capital — and it does this in return for a promise to be repaid in dollars. Since the US only borrows in dollars, China has to denominate its advanced capital in dollars for the purpose of lending it to the US. However, at least ideally, China’s capital could take the form of gold or copper, rupees or rubles, etc — once sold for money it can become anything else. What form China’s converted capital takes falls under the heading of what MMT calls a ‘portfolio change’, and insofar as the particular form the money capital takes is a matter of how China balances its portfolio, I have no interest in it at all. I am only concerned to investigate why China would advance its commodity capital to the US based on an agreement to be repaid in worthless fiat.

Moreover, since China cannot counterfeit US dollars, it can only come into possession of these dollars through exchange. Unlike Washington, which can create its dollars out of nothing, China must produce and sell the product of China’s labor in the world market. After this sale, it now has in its hands several trillion dollars that it can use as it sees fit. And what use is fit? Like Washington, China is a national capital, which means it is only interested in those uses for its money capital that increases its value. China could invest in its backward agriculture, or it could lend out the dollars to Africa; however, if it does the first, millions more displaced farmers will be streaming into its cities seeking work. If it does the second, the money capital might not be repaid, or may even end up in Swiss Bank accounts. Lending to Washington may seem like a good choice: there is almost no risk of default and China would not be forced to reduce hours of labor.

Overproduction of national capital and US treasuries

Like any capital, China is constantly trying to maximize the production of surplus value. This sets a limit on how much of the newly produced surplus value can be reinvested back into China. The additional surplus value must now find new markets or suffer devaluation. Fortunately, on the other side of the planet, where China’s biggest market is located, the fascist state offers to take China’s excess capital off China’s hands to splurge on its own military ‘investment’.

What counts for China is not the value of the money capital, but its use value: that is capital, i.e., self-expanding value, employed for production of surplus value and nothing else. If this money capital cannot function as capital, it ceases to be capital and becomes a lifeless pile of George Washingtons — every bit as valueless as the cloth on which it is printed.

As a national capital China is like any other capital — seeking only self-expansion. It is true that this particular capital, and the others like it, is also a state power, but insofar as it functions as a capital, this state power is subject to all the laws of the capitalist mode of production that apply to any other capital. When it lends its money capital to the US, therefore, what China aims for is not a pile of valueless George Washingtons, but a stream of surplus value. The treasuries China holds are nothing more than claims on the future surplus production of the so-called ‘private sector’ of the world market.

When China looks around to the world market to find somewhere to invest its excess capital, what does it see? We already know China is holding money and can, therefore, purchase anything it might want. What it wants is a purchase that will add to the value of its capital, so it looks at possible purchases with a discerning eye. By the same token, every commodity is a whore and wants to sell itself to the highest bidder. However, China’s capital is not a John — it has no interest in pleasure — it only seeks a return on an investment. Every commodity on the planet offers itself up as the one commodity able to make the dreams of China’s capital come true and every owner of a commodity competes to attract China’s capital.

Each of these owners promise the same thing:

“Buy my commodity and realize your fantasies of constant self-expansion!”

In this vein, US treasuries are just another investment opportunity and promise the same thing as any other commodity seller: an average rate of profit on the advanced capital. And, like every other investment quack, the US treasury department claims to have an edge over its competition, some ‘inside information’, some ‘secret method’. Anyone who has placed their wages in a 401k knows how this game works:

“Invest with me and make millions overnight!”

And each investment carries the same disclaimer:

“You may lose all of your cash.”

The only exception to this rule is state debt, and only insofar as this debt is denominated in a currency controlled by the state in question.

http://www.informationclearinghouse.info/article39749.htm

The later part of the above article touches on the theme of this post concerning the future status of the reserve currency although the opening sections about gold manipulation may also be of interest. Frankly the gold price befuddles me so its hard to know how much credibility to place in manipulation theories. What you and Sam WIlliams have convinced me is that gold should be seen as a money not just a commodity yet the movements in the gold price seem to indicate it is just another commodity caught in the early stages of the deflationary spiral.

With the US dollar deficits necessary as a means of soaking up the surplus value of countries like China and the dollar denominated assets like Treasuries offering such paltry returns this indicates the global profit rate is very low/the risks on other assets are very high otherwise they would invest their surpluses in assets generating a safer and higher rate of return. Even the more honest observers like the Bank of International Settlements and Bill Gross can see that their are grave risks with relying on ever greater expansion of money through monetising government debt but it seems there really is no other way to fix the financial system (ie return capital to profitability without the massive destruction of capital).

Even with the LoV and the tendency for the falling rate of profit, you cant exponentially expand debt forever eventually you run out of road

http://www.pimco.com.au/EN/Insights/Pages/For-Wonks-Only.aspx

Could I suggest that these three posts be revised into one article and published in a journal that would publish non-neoclassical materials as I would be interested to see the MMT response to your arguments made

LikeLike

I don’t understand your suggestion the U.S. might “counterfeit” its own currency when it has the legal authority to do whatever it wants with that currency.

As for China, the reasons for its desire to net save in USD are not that opaque.

1) orienting its economic development around exports which would be repaid in the reserve currency enabled the country to import advanced technologies with which to build its industrial base.

2) International oil trading is denominated in USD

3) Hoarding USD enables China to maintain an exchange rate favorable to its position as a net exporter

4) The whole point of an international reserve currency is that it’s easy to use and you can buy most anything you want with it. The US is the only country on the planet willing and able to run the trade deficits necessary to enable this function.

None of this is outside the scope of MMT; Wray has written that he fully expects the US to eventually lose its status as reserve issuer at some point in the medium-long term.

LikeLike

What you call printing currency is actually counterfeiting. The fact that it is “legal” does not change this. It also is legal to murder unarmed young men in the streets or invade and occupy other countries on unfounded pretexts. Stop confusing what is “legal” with what is actually taking place.

LikeLike

No, printing currency is not counterfeiting. Stop making shit up, and stick to the facts.

If you print copies of US government currency without permission, that is counterfeiting. If the US government prints copies of Euro currency without permission, that is counterfeiting.

If the US government prints US government currency, that is not counterfeiting. This is very simple and easy to understand.

There is no need for you to abuse the english language. Stick to what the word ‘counterfeiting’ actually means, instead of making up your own bullshit definitions.

LikeLike

Of course, I did not make the word up. Counterfeiting was always a term Marx used to describe over-issuing currency: https://books.google.com/books?id=TsSBM_UcsCAC&pg=PT25&lpg=PT25&dq=counterfeiting+currency+marx&source=bl&ots=HC9LavQgt-&sig=EPYcdzfS_tHf0-p8orG-Y3VlTM4&hl=en&sa=X&ei=mS2dVbTNPMakgwTwvYLwCQ&ved=0CCUQ6AEwAQ#v=onepage&q=counterfeiting%20currency%20marx&f=false

LikeLike

Define ‘over-issuing’.

LikeLike

Over-issuing occurs when the state forces more currency into circulation than is required given some definite commodity standard of prices. I explain the relation between currency and money in labor theory here: https://therealmovement.wordpress.com/2015/06/12/reply-to-lk-how-labor-theory-of-value-destroys-fiat-money/

LikeLike

First of all, increasing the supply of currency is not the same thing as “forcing” an increase in the quantity of currency in circulation. If, force example, I drop newly-printed dollar bills from a helicopter and people choose to pick them up and then spend them I am not “forcing” them to do that or “forcing” any sellers of goods to accept them (or to accept them in exchange for a fixed quantity of goods).

Secondly, you have already contradicted yourself, as you originally stated that printing currency is counterfeiting, now you are saying that printing more currency than is “required” (according to you) is counterfeiting.

Thirdly, the government does not promise that its currency will always have a fixed exchange value in terms of some particular commodity. Nor does it promise that its currency will always have a given, fixed ‘purchasing power’. In fact it explicitly states that the purchasing power of its currency can be expected to fall over time. So it is not deceiving people or engaging in fraud by promising one thing and secretly doing another.

So you have provided no reason to describe the issuance of fiat currency as ‘counterfeiting’.

LikeLike

Again, you are trying to tell me Marx was wrong. I accept that you believe this. However, Marx’s argument is not in agreement with the one you are making here. You need to familiarize yourself with his argument — in fact, rip it apart if you can. But don’t tell me Marx does not agree with you, which is all you are saying. I already know this.

LikeLike

No, I am not just telling you that Marx was wrong. I am giving you specific reasons for why it is incorrect to describe the printing or issuance of currency as ‘counterfeiting’, which is how you described it.

In order for something to be considered counterfeiting there has to be an act of deception or fraud. For example, if you print copies of dollar notes and then pretend that they were issued by the US government, you are engaged in deception and fraud (because they were not issued by the US government), and therefore you are counterfeiting.

IN contrast, if the US government issues US government dollar notes it is not engaged in counterfeiting as it is not pretending to issue anything other than US dollar notes.

Your claim that “over-issuance” of currency is counterfeiting appears to rest on the assumption that inflation (i.e. a fall in the purchasing power of currency) is counterfeiting. However that is obviously false, as inflation does not need to involve any form of deception or fraud.

LikeLike

Duly noted. I think we are done on this subject, right? In the future, when seeing the word, counterfeiting, on my blog, substitute any word you consider appropriate. 🙂

LikeLike

Basic misunderstanding here on your part:

Wray/Tymoigne: “The simple fact is that almost all monies of account are ‘state monies’”

You: “I will overlook the questionable assertion that “almost all monies of account are ‘state monies’”. For July alone, in the US, consumer credit outstanding — a money form that is not in any way a ‘state money’ amounted to $3.2 trillion. This private money is, of course, denominated in US dollars, but it is a privately issued money form that seldom takes the form of state currency.”

Private credit (or ‘private money’) is not the ‘money of account’. As you say, it is denominated in US dollars, i.e. the money of account.

LikeLike

According to Marx, “money serves as money of account whenever it is a question of fixing the value of an article in its money-form.”

As you know, state issued currency has no value and thus can not fix the value of a commodity. You will just have to accept that labor theory is not MMT and be satisfied to understand how labor theory describes things if you want to learn anything new.

LikeLike

labour theory is that labour determines the value of commodities in equilibrium except that it doesn’t because there is a uniform rate of profit.

LikeLike

Labor theory also state is doesn’t for the very reason that you pointed to. Thus labor they state both that the value of any commodity is the labor time required for its production and that it this labor time plus an average rate of profit. Labor theory, in other words, argues prices are ultimately incoherent and express a contradiction that capitalism cannot overcome.

If you would like to know more aout this, i suggest you read my post here: https://therealmovement.wordpress.com/2015/06/14/reply-to-lk-notes-on-the-historical-and-monetary-implications-of-the-transformation-problem/

LikeLike

alternatively you could use occam’s razor and conclude that the labour theory of value is wrong because it does not explain actual prices. At the very least it is just an unverifiable assumption.

LikeLiked by 1 person

That would be the easiest solution. Fortunately, in this case, it is not sufficient to explain deflation and inflation — or even why commodities can appear in the market with no prices at all.

LikeLike

“As you know, state issued currency has no value”

It does have value, in the sense that you can buy things with it.

What you mean is that you think it has no ‘value’ in marxian terms because there is no labour involved in its production.

However, even if you accept Marx’s theory, it is possible for something to have a market price above its supposed ‘labour value’ in the case of a monopoly, which is what MMT says fiat money is.

LikeLike

In labor theory, a currency does not have to have value to serve as means of exchange.

LikeLike

Alternatively you could use occam’s razor and conclude that the labour theory of value is wrong because it does not explain actual prices. At the very least it is just an unverifiable assumption.

LikeLike

“I want to reiterate that fascism, in the sense I use the term, only describes a state managed economy”

However, that is not what the word ‘fascism’ means, so again you are just making up your own bullshit definitions.

LikeLike

Really? Please define it. Right here, in a comment response to this one.

LikeLike

just to clarify, you believe that state socialism is actually fascism, right?

What about Marx’s ‘dictatorship of the proletariat’, or the socialist stage preceding full communism. Is that also fascism according to you?

LikeLike

Yes. Fascism is an alternative or parallel path to communism; a path followed by capitalist state management of the economy. It should not be confused with socialism in which the state is a workers’ state or association.

LikeLike

so you’re making up your own definitions, in which there is apparently only ‘laissez faire capitalism’, fascism, ‘workers’ state’, or full communism.

If you were using the english language instead, then you would be able to describe other forms. But you are using your own made-up language instead.

LikeLike