(And they can’t explain why Keynesianism collapsed either)

Part Two

This is part two of the series, “How fiat currency killed Marxism”. Part one is here.

At the high level of abstraction of Capital, money has to be a commodity, because Capital presents a theory of a “pure” capitalist economy, without state intervention. And in the 19th century laissez-faire capitalism (without state intervention) that Marx was analyzing, money was a commodity and money had to be a commodity in its functions of measure of value and store of value. However, in the post-1973 contemporary capitalism, money is no longer a commodity (i.e. is no longer convertible into gold at a fixed exchange rate), and money does not have to be a commodity in Marx’s theory. The state-guaranteed fiat money serves the same purpose as gold under the gold standard – it provides an observable, homogeneous, quantitative, and socially valid expression of abstract labor. —Fred Moseley, Money has no price

At the high level of abstraction of Capital, money has to be a commodity, because Capital presents a theory of a “pure” capitalist economy, without state intervention. And in the 19th century laissez-faire capitalism (without state intervention) that Marx was analyzing, money was a commodity and money had to be a commodity in its functions of measure of value and store of value. However, in the post-1973 contemporary capitalism, money is no longer a commodity (i.e. is no longer convertible into gold at a fixed exchange rate), and money does not have to be a commodity in Marx’s theory. The state-guaranteed fiat money serves the same purpose as gold under the gold standard – it provides an observable, homogeneous, quantitative, and socially valid expression of abstract labor. —Fred Moseley, Money has no price

If Keynesian currency devaluation allows the state to maintain production for profit by reducing the real value of wages, why were Keynesian policies abandoned in the late 1970s for neoliberalism? To explain why this happened, requires some discussion of the problem with simple Keynesian “full employment” policies.

Carchedi’s fruitless search to discover how Keynesianism works

In 2012, Gugliemo Carchedi tried and failed to explain how Keynesian policies worked. The best he could come up with is that Keynesian policies did not and could not possibly work either by redistribution of the social product between the two classes, nor by increasing investment for the purpose of creating additional surplus value. If neither of these policies could explain the success of Keynesian policies in the Golden Age of Fascism, was there another way it worked? Here, Carchedi almost stumbles over the answer despite himself:

“Some Keynesian authors propose to stimulate demand neither through redistribution nor through investments but by increasing the quantity of money. The assumption is that the ultimate cause of crises is lack of demand so that a higher quantity of money in circulation would stimulate demand.”

According to Carchedi, the problem with counterfeiting the currency is not, as Austrians believe, that printing currency is inflationary. Rather it was that the state could not create money out of nothing. It could only create credit:

“By creating credit, one does not ‘create money out of nothing’, an absurd proposition. Out of nothing, one can create nothing. Simply by creating credit one creates debt. So the crisis is postponed to the moment of debt repayment.”

As Carchedi argues, the state cannot ‘create money out of nothing’. However it never occurs to him that the fascist state does not issue credit money either. To issue credit money the state must first produce a commodity and advance this commodity to a buyer who purchases the commodity with the expectation that the money necessary for the purchase will be paid at a later time. In the interim, the transaction is suspended, so to speak, until the debt is actually paid. Since (on our assumption) the state does not produce any commodities, it cannot create credit money. Moreover, the state cannot create debt either. Like any other entity in society, it can incur a debt, but only if a seller advances his or her commodity to it on credit. Nevertheless, despite the fact that, logically, no one in society can “issue debt”, we find just this sort of thing routinely being discussed in the press as if it could actually happen. Washington allegedly issues treasuries and auctions these treasuries off to the highest bidder. In this bizarre world of late capitalism, it appears the state can actually “issue” debt as if this debt were a commodity.

In the end Carchedi may have failed to explain how Keynesian policies work because he appears to accept the standard Keynesian boilerplate that they are trying to increase demand with higher wages and more investment. Once he realized Keynesian policies could not possibly work this way, it doesn’t seem to occur to him that Keynes’ model works by slashing wages in order to raise the rate of surplus value as Grossman predicted. Moreover, Carchedi may be entirely correct that the state cannot create money out of nothing, but this argument, although correct on the surface, overlooks a critical point: while the state cannot create money out of nothing, it can counterfeit its currency as much as it wants.

And state currency counterfeiting is the first step toward unraveling the mystery of why Keynesian policies of forcibly devaluing wages through currency depreciation were abandoned in favor of neoliberalism.

The standard of currency prices

The problem with Carchedi’s argument is that the thread of Marx’s argument has been lost by Marxists theoreticians. If we go back to part 1 of volume one of Capital, it is evident from Marx’s argument on money that the token of money, inconvertible fiat currency, is a mere distraction in analysis. The currency itself has no value at all, and only represents some definite quantity of value symbolically. It is a placeholder for exchange value, not exchange value itself. To discover what quantity of value any unit of a currency symbolically represents, we must actually exchange it for real (commodity) money. The exchange tells us what the currency is “worth” in labor theory terms. Marx calls this ratio between a token and money the standard of price; and with it we can “translate” (so to speak) prices into their actual labor values.

If one unit of the currency can buy an ounce of gold, the price standard is that a commodity with the price of $10 has a value equal to 10 ounces of gold. Whatever is the value contained in ten ounces of gold – and we could not possibly know what this quantity is – is also contained in the commodity. On the other hand, if it takes $100 to buy an ounce of gold, a commodity with a price of $10 will contain as much value as 1/10 of an ounce. Both commodities have a price of $10, but the value expressed in this price can represent wildly differing quantities of value.

We have no way of knowing how much value is in the commodity and can only infer it contains value because it has a price. But even this price is meaningless unless we can find a single uniform standard for measuring all prices — a commodity money. Which means, once Nixon floated the dollar against gold, prices no longer symbolically represented the value of any commodity.

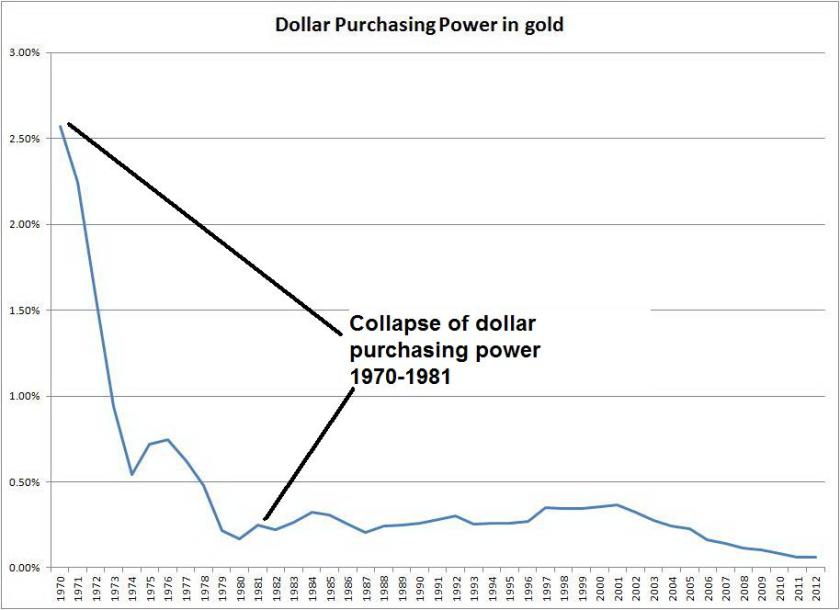

And without a standard of prices in the economy you can guess what happened: Floating the dollar against gold triggered a huge implosion in the purchasing power of the dollar — a currency crisis; or what is the same thing, produced the supposedly paradoxical effects of massive unemployment and rampant hyperinflation — i.e., “stagflation”, something bourgeois economic theorists assumed was impossible, until it happened right in front of them.

The rapid depreciation of the currency was not itself unusual; having happened between many different currencies over the past 45 years. And the reason for these sorts of currency crises is easy to understand: When two currencies are pegged to one another, over time imbalances in the two economies build up requiring an adjustment to a new exchange rate. Periodically, these pegged currencies are forcibly ‘revalued’, resulting in a sudden and sharp change in their exchange rate.

To give an example, when this happened in Argentina in 1999, the government was forced to devalue the peso against the dollar, resulting in a deep protracted depression. Something similar happened in 1971 when Nixon “closed the gold window”: the United States was plunged into a depression that lasted some 10 years. However, this does not mean the 1970s depression was caused by the US going off the gold standard. The opposite is actually true: both the collapse of the gold standard and the depression were products of a deep crisis that had already gathered strength within the economy.

Crises and the overaccumulation of capital

If the depression was not caused by Nixon taking the dollar off the gold standard, what caused it? Labor theory’s answer is that the depression of the 1970s was caused by overproduction of capital. Yaffe and Bullock put it this way:

“As the crisis of overproduction of capital deepens, capital cannot be reproduced since commodities cannot be sold at their prices of production, capacity is underutilised and workers are unemployed. An overproduction of capital then leads to capital values being written off – depreciation of capital – and social labour is ‘devalued’ as the ranks of the reserve army are swelled and wages are driven below the value of labour power.”

According to Yaffe and Bullock then, overproduction of capital resulted in the sudden contraction of investment and employment.

The Keynesian policy response to this crisis would have been to sharply reduce wages so as to maintain full employment. This should have been effected by sharply devaluing the dollar against gold, as Roosevelt did during the Great Depression. What Nixon did instead was to float the dollar against gold, rather than simply devaluing it, bringing the gold standard to its final ignominious end.

Now here is the thing: In a depression, the aggregate value of the capital in circulation within the economy suddenly contracts owing to the falling rate of profit. This sudden contraction sets in motion other equally sudden adjustments. In a commodity money regime like the gold standard, the quantity of commodity money in circulation would contract as well. According to Marx’s theory of money, the circulation of money is only a reflex of the circulation of commodities so when the value of commodities declines so must the quantity of money. This, however, is decidedly not true for valueless inconvertible fiat currency regimes. Instead, as Marx explained in chapter 3 of Capital, volume one, suddenly and without warning the economy was whacked by hyperinflation:

“If … all the conduits of circulation were to-day filled with paper money to the full extent of their capacity for absorbing money, they might to-morrow be overflowing in consequence of a fluctuation in the circulation of commodities. There would no longer be any standard. If the paper money exceed its proper limit, which is the amount in gold coins of the like denomination that can actually be current, it would, apart from the danger of falling into general disrepute, represent only that quantity of gold, which, in accordance with the laws of the circulation of commodities, is required, and is alone capable of being represented by paper. If the quantity of paper money issued be double what it ought to be, then, as a matter of fact, £1 would be the money-name not of 1/4 of an ounce, but of 1/8 of an ounce of gold. The effect would be the same as if an alteration had taken place in the function of gold as a standard of prices. Those values that were previously expressed by the price of £1 would now be expressed by the price of £2.”

According to Marx’s theory, then, once Nixon severed the dollar from gold and let it float, currency prices no longer had any standard, nor anything else mediating them. So, quite naturally, they exploded. In turn, the purchasing power of the dollar, measured in gold, collapsed, exactly as Marx predicted in chapter 3 of Capital:

Even as the then young Marxist scholar George Caffentzis sat in his Capital study group, wondering aloud with his fellow students if capitalism or Marxism had died, the dollar was reacting just as Marx predicted it would 100 years earlier. Unfortunately, even 41 years later, after he had ample time to reflect on the events of 1971, Caffentzis was still completely clueless.

Most damning of all, there is not a single Marxist theorist who realized a full blown depression occurred during the 1970s — not one. They were so busy tracking worthless paper dollars measures of GDP, they completely missed it.

The state topples over …

But floating the dollar against gold had another, more profound, effect: it signaled the end of the Keynesian golden age. Unfortunately, I have gone on too long in this post, so I will take this up in the next, and hopefully final, installment of this series.

Continued in part 3

have you ever engaged in debate s with carchedi or other . i think it will be interesting if you will debate with Michael roberts .

LikeLike

Debating Carchedi is far less interesting than it sounds. He has very little grasp of Keynesian economic theory he professes to criticize and almost no grasp of its implications for labor theory of value. Roberts waves the law of the tendency of the profit rate to fall around like a flag, but appears to have little or no familiarity with the basics of Marxist theory. I do enjoy reading them both, however. They often force me to think about things I have been ignoring.

LikeLike