I have been avoiding David Graeber’s book, DEBT: The first 5000 years, on the assumption I was not qualified to address an issue so steeped in concrete historical evidence. Only now do I feel I have a credible basis for examining the book.

After reading chapter 2 of the book (which is as far as I have gotten so far) I am surprised to find out it is not quite what I expected. It turns out, contrary to much of the hype with which this book has been greeted, Graeber has already acknowledged money and commodity exchange already existed as far back as ancient Sumer — some 5500 years ago. What Graeber is instead trying to show in his book is that a form of credit money emerged into general use long before the coining of currencies — which is an altogether different argument.

After reading chapter 2 of the book (which is as far as I have gotten so far) I am surprised to find out it is not quite what I expected. It turns out, contrary to much of the hype with which this book has been greeted, Graeber has already acknowledged money and commodity exchange already existed as far back as ancient Sumer — some 5500 years ago. What Graeber is instead trying to show in his book is that a form of credit money emerged into general use long before the coining of currencies — which is an altogether different argument.

The argument, although convincing, leaves as many questions as it answer, as I will show in the next few posts.

*****

NOTE ONE: Did money emerge out of commodity production and exchange?

One of the most important points of Graeber’s argument on the genesis of money is found in chapter 2 of his Debt. I have been reading and rereading it to familiarize myself with it. The subject addressed in chapter 2 is the historical evidence for the assertion that money emerged out of commodity production and exchange. — what Graeber and many modern simpleton economists refers to as “barter”.

Graeber describes the view he is criticizing this way:

“When economists speak of the origins of money, for example, debt is always something of an afterthought. First comes barter, then money; credit only develops later. Even if one consults books on the history of money in, say, France, India, or China, what one generally gets is a history of coinage, with barely any discussion of credit arrangements at all.”

As can be seen from the passage above, Graeber appears to conflate the emergence of money with the emergence of coins — i.e., currency or tokens of money. This conflation is somewhat understandable since simpleton economists themselves often use the terms ‘money’, ‘credit’ and ‘currency’ interchangeably and seldom, if ever, make a distinction between these money forms. Because of this, a discussion of the origin of money can be easily confused with a discussion of the origin of currency..

According to Graeber, a detailed study of the records of Mesopotamia challenge the modern assumption that money emerged from barter:

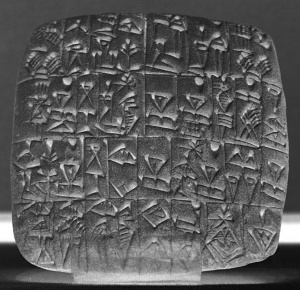

“[The] most shocking blow to the conventional version of economic history came with the translation, first of Egyptian hieroglyphics, and then of Mesopotamian cuneiform, which pushed back scholars’ knowledge of written history almost three millennia, from the time of Homer (circa 800 BC) , where it had hovered in Smith’s time, to roughly 3500 BC. What these texts revealed was that credit systems … actually preceded the invention of coinage by thousands of years.”

However, on what is this credit system itself based? Graeber goes on to describe the system:

“The Sumerian economy was dominated by vast temple and palace complexes. These were often staffed by thousands: priests and officials, craftspeople who worked in their industrial workshops, farmers and shepherds who worked their considerable estates. Even though ancient Sumer was usually divided into a large number of independent citystates, by the time the curtain goes up on Mesopotamian civilization around 3500, temple administrators already appear to have developed a single, uniform system of accountancy-one that is in some ways still with us, actually, because it’s to the Sumerians that we owe such things as the dozen or the 24-hour day. The basic monetary unit was the silver shekel. One shekel’s weight in silver was established as the equivalent of one gur, or bushel of barley. A shekel was subdivided into 60 minas, corresponding to one portion of barley-on the principle that there were 30 days in a month, and Temple workers received two rations of barley every day. It’s easy to see that ” money” in this sense is in no way the product of commercial transactions. It was actually created by bureaucrats in order to keep track of resources and move things back and forth between departments.”

Here, according to Graeber, we have rough equations for the value of two separate commodities, measured in terms of silver: 30 day’s laborer’s wages = 1 silver shekel and, 1 bushel of barley = 1 silver shekel. Both 30 day’s wages and 1 bushel of barley are determined (by whatever means; Graeber doesn’t tell us) to have a value equal to that of 1 silver shekel.

These equations meets all the basic conditions of a monetary system. Graeber argues this monetary system appears to arise well before the introduction of coinage by several thousand years. Nevertheless, as Graeber admits, this is a monetary system in which the values of commodities are already being expressed in the use value of a money commodity, silver.

Does money have to circulate as currency?

What is missing from this monetary system is a true currency:

“Silver was, effectively, money. And it did indeed circulate in the form of unworked chunks, “rude bars” as Smith had put it. [however] silver did not circulate very much. Most of it just sat around in Temple and Palace treasuries, some of which remained, carefully guarded, in the same place for literally thousands of years.”

According to Graeber, then, money in the form of a huge hoard of silver bars already existed at the time the credit system emerged. This commodity money mostly did not physically circulate in the form of currency, but sat in hoards held by the temple complex.

If Graeber is correct on this, why can we still call the hoard of silver bars money when it never circulated in the ‘economy’? For a simple reason: currency (money as a circulating medium for commodities) performs only one of the many functions of money. According to Marx, whose theory of money Graeber never discusses, at least in this chapter, the principal function of money is to serve as a material to express the value of other commodities:

“The first chief function of money is to supply commodities with the material for the expression of their values, or to represent their values as magnitudes of the same denomination, qualitatively equal, and quantitatively comparable. It thus serves as a universal measure of value. And only by virtue of this function does gold, the equivalent commodity par excellence, become money.”

Contrary to many other theories of money, in Marx’s labor theory of value money actually need not circulate in market exchanges in order to perform this function — the function can be expressed in a purely notional fashion. This reading of his theory in relation to Graeber’s evidence suggests that in the function of universal measure of the value of barley and other commodities silver in ancient Sumer fully met the definition of money. And, as I read Graeber, he seems to be correct to call the accounting system of ancient Mesopotamia a monetary system based on silver as the universal equivalent.

Why currency didn’t emerge in ancient Sumer?

Why did coinage of money for use in exchange lag so far behind the emergence of money itself? Graeber argues both the material and technology was available to introduce coinage. Why coinage never emerged,Graeber thinks can be explained at least in part by the fact it was not necessary during the period of ancient Sumer — payment in kind, i.e., barter, predominated.

“One reason was that silver did not circulate very much. Most of it just sat around in Temple and Palace treasuries, some of which remained, carefully guarded, in the same place for literally thousands of years. It would have been easy enough to standardize the ingots, stamp them, create some authoritative system to guarantee their purity. The technology existed. Yet no one saw any particular need to do so. One reason was that while debts were calculated in silver, they did not have to be paid in silver-in fact, they could be paid in more or less anything one had around. Peasants who owed money to the Temple or Palace, or to some Temple or Palace official, seem to have settled their debts mostly in barley, which is why fixing the ratio of silver to barley was so important. But it was perfectly acceptable to show up with goats, or furniture, or lapis lazuli. Temples and Palaces were huge industrial operations-they could find a use for almost anything.”

So, according to Graeber, the relative values of specific commodities were already being expressed in the form of silver in ancient Sumer. And, according to Graeber, even absent coining of silver there was some limited circulation on the margins of the temple complex; even evidence of a limited market where the prices of commodities, denominated in weights of silver, fluctuated according to supply and demand. What did not exist, however, was any evidence of coining of silver to serve as the currency in these transactions:

“In the marketplaces that cropped up in Mesopotamian cities, prices were also calculated in silver, and the prices of commodities that weren’t entirely controlled by the Temples and Palaces would tend to fluctuate according to supply and demand . But even here, such evidence as we have suggests that most transactions were based on credit. Merchants (who sometimes worked for the Temples, sometimes operated independently) were among the few people who did, often, actually use silver in transactions; but even they mostly did much of their dealings on credit, and ordinary people buying beer from “ale women,” or local innkeepers, once again, did so by running up a tab, to be settled at harvest time in barley or anything they might have had at hand.”

Moreover, according to Graeber, temple administrators already seem to have been routinely advancing credit (in the form of goods) to finance long distance trade in foodstuffs and related industries:

“We don’t know precisely when and how interest-bearing loans originated, since they appear to predate writing. Most likely, Temple administrators invented the idea as a way of financing the caravan trade. This trade was crucial because while the river valley of ancient Mesopotamia was extraordinarily fertile and produced huge surpluses of grain and other foodstuffs, and supported enormous numbers of livestock, which in turn supported a vast wool and leather industry, it was almost completely lacking in anything else. Stone, wood, metal, even the silver used as money, all had to be imported. From quite early times, then, Temple administrators developed the habit of advancing goods to local merchants-some of them private, others themselves Temple functionaries-who would then go off and sell it overseas. Interest was just a way for the Temples to take their share of the resulting profits.”

If Graeber’s reading of the historical record is correct, most people simply did not have any use for currency in their daily activities, although some sort of accounting system and credit emerged quite early. Instead, they employed some sort of credit system in daily transactions.

Were we currency before currency emerged?

What are we to make of this evidence provided by Graeber?

One problem with Graeber’s argument is that he makes no distinction between trade between merchants and the trade between merchants and consumers. Trade among merchants is typically never done in coin, but Graeber provides no information on how this trade was conducted specifically. (It may be that the term “rude bars” refers to silver bars, which may have been used in merchant trade.) While he explains that trade between dealers and consumers was typically conducted by running a tab that was periodically settled in kind.

This point is important because Graeber simply tells us the value of commodities like barley were “set” by the temple authorities. He never exactly explains how these prices were set, although he did admit supply and demand caused prices to fluctuate outside the temple. Thus, it is difficult from his description to tell if prices within the temple fluctuated as well, or were they set administratively and not subject to supply/demand fluctuations?

Interestingly enough, Marx described credit as essentially a person standing in for his money. If Graeber is correct, one interpretation of the evidence may be that we first encounter credit in the form of a person not just standing in for money, but also standing in for currency itself; in effect buyers physically served as their own ‘coin’. In ancient Sumer, you were your own coin back in the day. You were the currency before currency itself existed.

The argument Graeber makes in chapter 2 is extremely powerful in terms of making a critical analysis of the category of money. He is essentially describing how money only gradually became this other thing standing over against us, an alien power.

These are just a few questions Graeber didn’t answer in chapter 2 of his Debt.

I think Graeber believes that ‘exchange based on loaning your neighbors your shit’ is categorically different from ‘exchange based on value’. This is elaborated somewhat more in depth in his “Towards an Anthropological Theory of Value” which is built around his misunderstandings of the Mauss “gift economy” school. I don’t think it’s without interest but Graeber’s resistance to careful readings of technical arguments is frustrating… but, in an economy without literacy or basic accounting and where the amount of the commodities to be exchanged is small, I think that ‘value’ is a difficult proposition to argue for, for the transactions of “regular” people. “money” then becomes an imposition on the local “gift economy” by higher authorities, whether it is exchange valued in silver, or the Celtic ‘female slave’ backed tally sticks.

LikeLike